- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Re: 2017 Taxes error on Property Tax for 2016

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2017 Taxes error on Property Tax for 2016

I was notified by the Illinois Dept of Revenue I was issued an Illinois Tax refund on April 27, 29018 in amount of $421.00. A recent review of our records revealed that a portion of this refund was not due you and was the result of the following taxpayer error.

After review of the documents you submitted for your 2018 property tax credit, we also reviewed your 2017 property tax credit. You claimed more than the amount due on your property tax bill. therefore we have adjusted your 2017 Schedule ICR, line 4a to the tax due on your 2016 property tax bill.

Myresponse.

1st thing I did was check with the bank and get copies of my 1098 Substitutes for years 2015-2018.

2nd thing I did was check Turbo Tax 2017 for the property tax inputs.

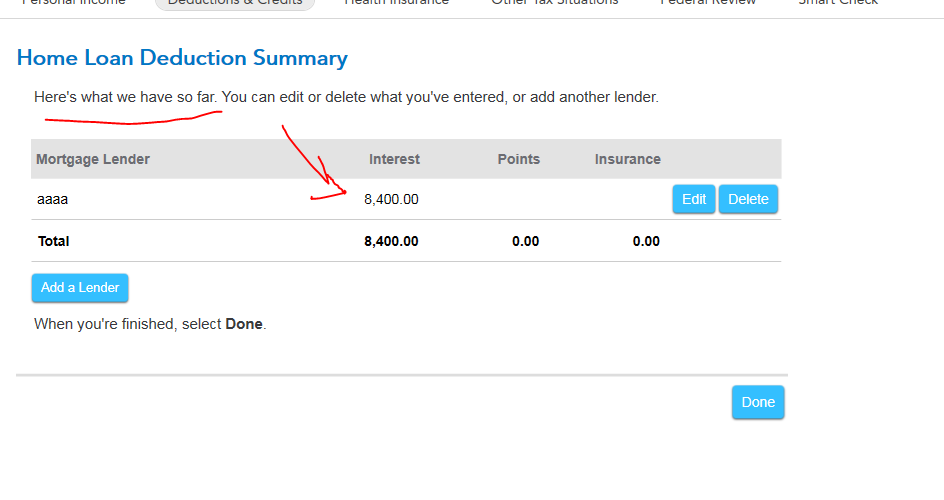

The amount I see on the 1098 was $4122.10, when I check the Easy Step for Deductions & Credits I see Property Taxes references $8244.00.

When I click on the Amount I see the following Description:

Real Estate tax Paid on Principal Residence - $4,122

Real Estate Tax Reported on Form 1098 - $4,122

When I access Home Mortgage Interest worksheet referencing the Property Tax on line 7 for the amount of 4,122,10.

On the Schedule A - Itemized Deductions I see on line 6 - REAL ESTATE TAXES - $8,244. When I double click on the amount I see on the TAX and INTEREST DEDUCTION WORKSHEET Line 2a Real Estate Taxes not entered on form 1098 - $4,122 and on Line 2b Real Estate Taxes entered on Home Mortgage Int Worksheet - $4,122 and on Line 2g - Total from 2a though 2f = $8,244.00.

What I do not know is why did not Turbo Tax flag this as an error. I reran this again today and nothing was flagged as an error.

Issues.

So now Illinois Dept of Revenue has notified me of the error, the idea regarding the Federal Return made me question what do I need to do to make this right.

The Refund from the federal side was $70.00 with the double amounts for the property tax added. If I reduce the Property Tax amount to get it inline with what the 1098 indicated @ $4122.10 I now owe $961.00,

I am just confirming that this is correct and if so hiow does one ammend this return>

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2017 Taxes error on Property Tax for 2016

@jourdanr wrote:

What I do not know is why did not Turbo Tax flag this as an error. I reran this again today and nothing was flagged as an error.

TurboTax does not flag it as an error because TurboTax has no way of knowing that it's an error. TurboTax has to rely on you to enter information accurately. If you enter your real estate tax in two different places, TurboTax has to assume that that's how much you paid. It cannot assume that having the same amount in two different places is an error. You have to look over your tax return before you file it. If you had seen the $8,244 real estate tax amount on the TurboTax screen or on Schedule A before you filed the return, I'm sure you would have realized that it was wrong and corrected it.

@jourdanr wrote:

hiow does one ammend this return>

Go to the following link for instructions to amend a 2017 tax return that you filed with the CD or download TurboTax software.

How do I amend my 2017 return in the TurboTax CD/Download software?

Before you start to amend the return, save a copy of the .tax2017 data file with a different name. Use one copy to amend the return, and keep the other copy as a backup of the original return.

An amended return has to be filed on a special form, Form 1040X. It cannot be e-filed. You have to print it, sign it, and file it by mail. It takes the IRS up to 16 weeks to process an amended return.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2017 Taxes error on Property Tax for 2016

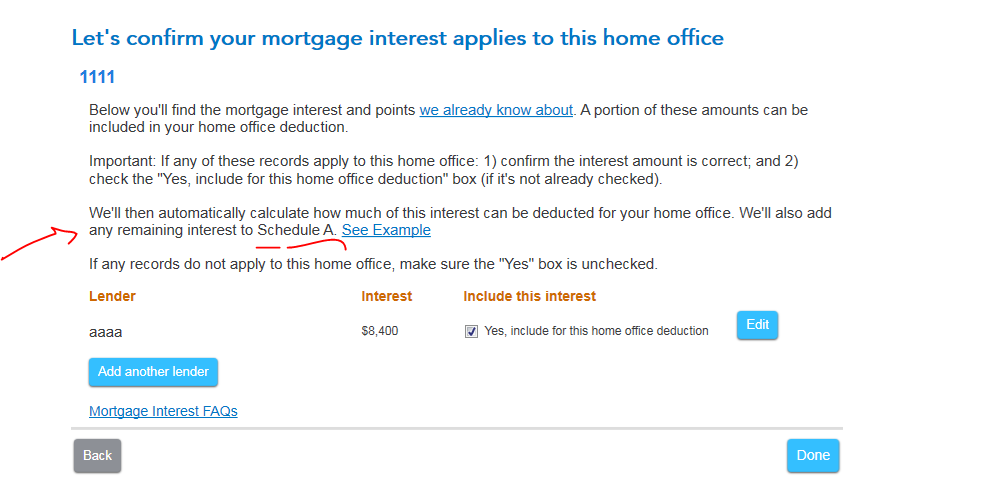

Review your entries in the Office in Home form 8829 & the Sch A ... this is the most likely place where the amount was entered by you twice ... if you had an OIH the personal portion would have been carried to the Sch A for you automatically ... the screen instructions later tell you the amount that was being carried and to not enter that amount again. Now if you enter the Sch A info first and then backed up to the Sch C & OIH this could have caused the warnings to not show properly ... again a user entry error ... NEVER enter the same amount twice and ALWAYS follow the interview in a forward motion ... jumping about can cause unwanted errors.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2017 Taxes error on Property Tax for 2016

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2017 Taxes error on Property Tax for 2016

thanks for the explanation

Jourdan

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

2017 Taxes error on Property Tax for 2016

Thanks for the response

Jourdan

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Martin Yue

New Member

Bholden229

New Member

brockbank9-gmail

New Member

cenjames

New Member

helloTT102

New Member