- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- EFILE FAILURE TO COLORADO STATE TAX 2018

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

EFILE FAILURE TO COLORADO STATE TAX 2018

I paid turbo tax to efile Colorado state tax 2018 but just received the penalty letter from state that the payment was never received. I looked up the email from Turbo tax which shown the efile was accepted and it actually requires mailing in the check for the payment! what a joke! If it requires mailing, why does it call efile and why charge people for it? It is absolutely a fraud! I ended up paying hundreds of dollars for the interests. I will never use Turbo tax again!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

EFILE FAILURE TO COLORADO STATE TAX 2018

Sorry only the tax return is efiled. Accepted just means they accepted your return for processing. Only you would know if the tax due got paid. Your proof is your bank account statement or credit card statement showing the payment coming out. And Turbo Tax doesn't pay any tax due for you. Turbo Tax just sends your payment method to the state. You either put down your bank account number for the state to pull it directly out of your account or you needed to mail in a check. Most states don't let you pay by direct debit. Did you check your bank account to see if it came out? You should have an instruction sheet telling you how to pay it.

Check the printout or PDF of your return; look for the state cover sheet with the Turbotax logo. If you owed tax, it will show the payment information and how/when you decided to pay. Read the state payment instructions carefully since most states cannot be paid from within the TT system and requires additional steps.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

EFILE FAILURE TO COLORADO STATE TAX 2018

And how did you expect it to get paid? Didn't you notice it never came out of your bank account or charged to your credit card? Instead of mailing a check you probably could have paid it directly on the state's website.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

EFILE FAILURE TO COLORADO STATE TAX 2018

Turbotax did what it is designed to do which is complete a return that can be filed either by mail or efiled. It pays nothing for you ... it only forwards the payment info to the state and they must initiate the debit. Turbotax has no control over this portion of the process ... so if you timely filed and your direct debit info was correct then you must take it up with the state to find out why the payment did not happen correctly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

EFILE FAILURE TO COLORADO STATE TAX 2018

No tax-return software can provide you with the ability to pay Colorado state tax by direct debit; Colorado does not support providing an account number on the tax return. Colorado only supports payment by check or electronically by visiting Colorado's Revenue Online service:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

EFILE FAILURE TO COLORADO STATE TAX 2018

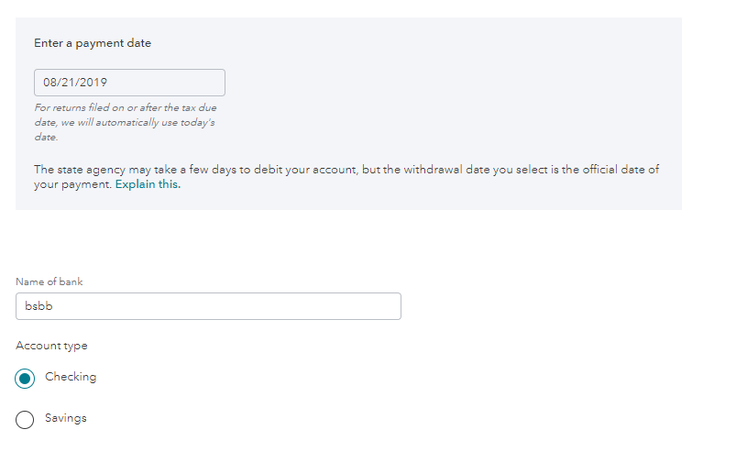

If that is true then the program gives conflicting information :

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

EFILE FAILURE TO COLORADO STATE TAX 2018

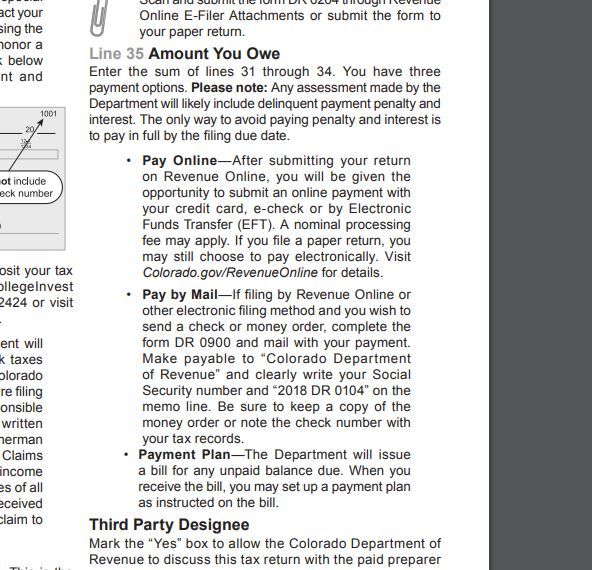

Here is the Colorado Instructions. Only 3 ways to pay a tax due:

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

aslxsantos

New Member

MLBrown84

New Member

rrinella23

New Member

dmmullen-foresee

New Member

linseymounsey

New Member