- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- After you file

- :

- Can you amend your return to add a charitable cash contribution under cares act? I am not getting the screen that I got when I originally filed. Couldn't resolve on phone

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can you amend your return to add a charitable cash contribution under cares act? I am not getting the screen that I got when I originally filed. Couldn't resolve on phone

Yes I do see "Wrap Up Tax Breaks". After I click that, I get the "Based on what you just told us, the Standard Deduction is best for you" screen. After I click continue, I go straight back to the "Here's the info for your amended federal return" main page. No matter what I do, I cannot get the page that asked about the $300 cash charitable contributions.

Who can I contact about this TurboTax issue? Because if all these people are telling me I should be able to do it, but I can't, and the person I spoke to on the phone said it could be an issue with my tax form, there has GOT to be someone to talk to about this. Can someone PLEASE get me in contact with someone who can help me. I am allowed to amend my return for this, but TurboTax will not let me, that isn't right.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can you amend your return to add a charitable cash contribution under cares act? I am not getting the screen that I got when I originally filed. Couldn't resolve on phone

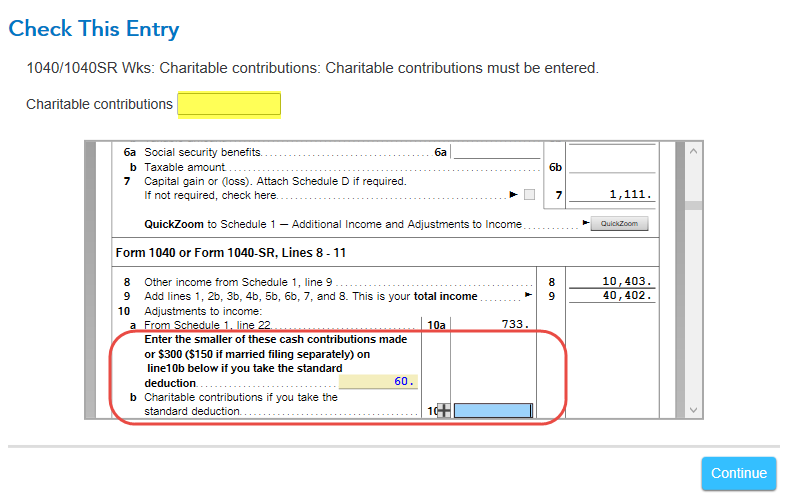

Just enter the total figure you contributed in the cash contributions section in the amendment process. You will be asked again during the SmartCheck review when you are getting ready to file your amended return. [See screenshot below.]

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can you amend your return to add a charitable cash contribution under cares act? I am not getting the screen that I got when I originally filed. Couldn't resolve on phone

What exactly do you mean by "cash contributions section"? I only have Charitable Donation section under Deductions & Credits. Is that what you mean? I entered the donations there and I do NOT get anything anywhere even after going through the entire rest of the process right up to re-filing. I do not get whatever screenshot you shared, nothing changes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can you amend your return to add a charitable cash contribution under cares act? I am not getting the screen that I got when I originally filed. Couldn't resolve on phone

It is possible this $50 donation change does not affect your return and therefore you will not see a change. You should check your originally filed 1040 to see that line 24 total tax may be zero and the amount that was withheld from your pay Line 25 has already been refunded on line 34. That would mean any additional deductions will not affect your returns.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can you amend your return to add a charitable cash contribution under cares act? I am not getting the screen that I got when I originally filed. Couldn't resolve on phone

I am not seeing how that connects to the allowable $300 in cash contributions under the standard deduction. Line 24 is not zero and line 34 is blank. I did not get a refund.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Can you amend your return to add a charitable cash contribution under cares act? I am not getting the screen that I got when I originally filed. Couldn't resolve on phone

To increase what donations were reported, yes, an amended return would be required, which you have begun. To return to the correct area an increase the Cares Act Donation, it must be entered in the original donation section.

Keep in mind that the Cares Act Charitable Donation amount is a deduction. This means it reduces Adjusted Gross Income, not your tax bill. If your tax rate was 10%, adding $50 to your Cares Act Donation would save $50x10%=$5 on your tax balance due.

You would see this reported on Line 1 of Form 1040-X in Column B as a net change.

If you do want to proceed, to return there, follow these steps:

- Inside TurboTax, in the search box, enter charitable donation.

- Select the Jump to link in the search results.

To qualify for the Cares Act above-the-line deduction up to $300 for all taxpayers except married filing separate, who would each have a maximum of $150, for standard deduction filers, the IRS clarifies that the contribution must be:

- a cash contribution

- made to a qualifying organization

- made during the calendar year 2020

For more information, see: Charitable Contributions - TurboTax Tax Tips & Videos

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

liebelt

New Member

tizzy2335

New Member

tek_tech

Level 2

jblaser129

Level 2

BME

Level 3