- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: Total Refund Received in 2018 & Total of all your payments and withholding & 1099G

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Total Refund Received in 2018 & Total of all your payments and withholding & 1099G

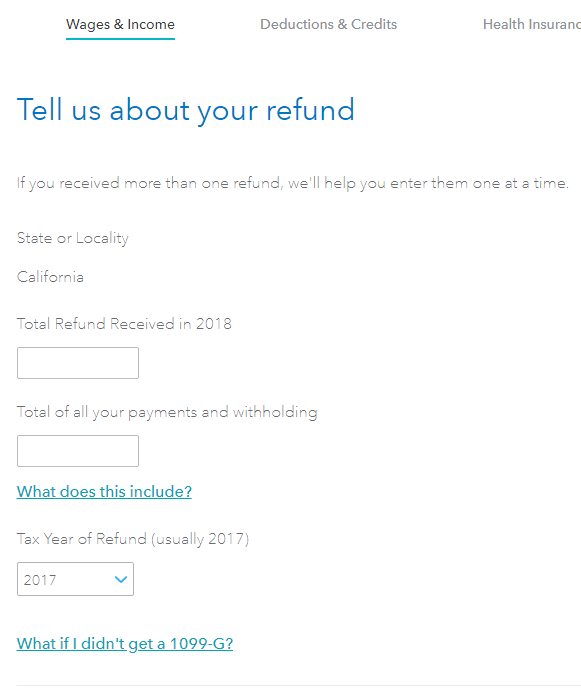

I have no idea for these two blanks:

1. Total Refund Received in 2018.

2. Total of all your payments and withholding.

Questions are:

1. TurboTax has automatically filled in a number $A for both.

2. Total refund of 2017 is not $A, and the amount I received is not $A either. But I can see the number $A shows in my tax return form 540, followed by "California income tax withheld".

3. I can not find total of all my payments and withholding. Also I can't see form 1099G in my tax return.

Please give me a guide how to fill in these two blanks.

Thank you!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Total Refund Received in 2018 & Total of all your payments and withholding & 1099G

See my answers and explanations below in bold.

1. Total Refund Received in 2018. This is your total California refund you received in 2018, when you filed your 2017 income taxes.

2. Total of all your payments and withholding. This is your total estimated tax payments (if you made any) and your total withheld from W-2 or 1099 forms.

Questions are:

1. TurboTax has automatically filled in a number $A for both. That makes sense if you filed with TurboTax in 2017. Just verify that they are correct.

2. Total refund of 2017 is not $A, and the amount I received is not $A either. But I can see the number $A shows in my tax return form 540, followed by "California income tax withheld". This should be the actual amount received in 2018, from your 2017 tax return that was prepared. If you received a different amount, then enter the amount you actually received.

3. I can not find total of all my payments and withholding. Also I can't see form 1099G in my tax return. Form 1099-G This is your total estimated tax payments (if you made any) and your total withheld from W-2 or 1099 forms for the 2018 tax year. Form 1099-G is a form the state sometimes sends to verify the state tax refund you received in 2018 (for your 2017 tax return, because it was prepared in 2018).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Total Refund Received in 2018 & Total of all your payments and withholding & 1099G

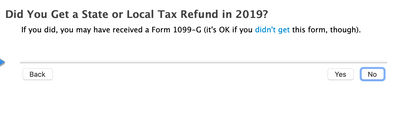

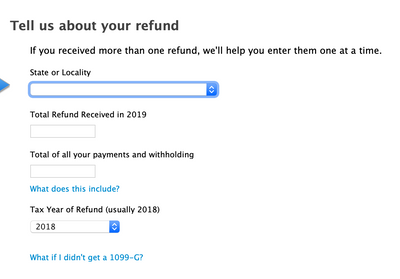

So the "Total of all your payments and withholding" is all state taxes withheld from my 1099-R, SSA-1099 and other payments to state made in 2019? (I'm working on 2019 return)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Total Refund Received in 2018 & Total of all your payments and withholding & 1099G

No, it is for 2018.

TurboTax is trying to determine if your refund is taxable, which depends on whether or not you deducted it in 2018 and received a tax benefit from the deduction.

The total of all your payments and withholding is all state taxes withheld shown on all income forms, and other payments to the state paid in 2018, such as quarterly payments.

@Inabutovsky

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Total Refund Received in 2018 & Total of all your payments and withholding & 1099G

I am still confused. I am working on tax return for year 2019. In that year I received state refund because I overpaid state taxes in 2018. So in "Total of all your payments and withholding" I need to put all my payments to the state tax plus all money which where withheld for state on forms 1099-R, SSA-1099 and other 1099. And I need to use 2018 forms for that and not 2019 forms?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Total Refund Received in 2018 & Total of all your payments and withholding & 1099G

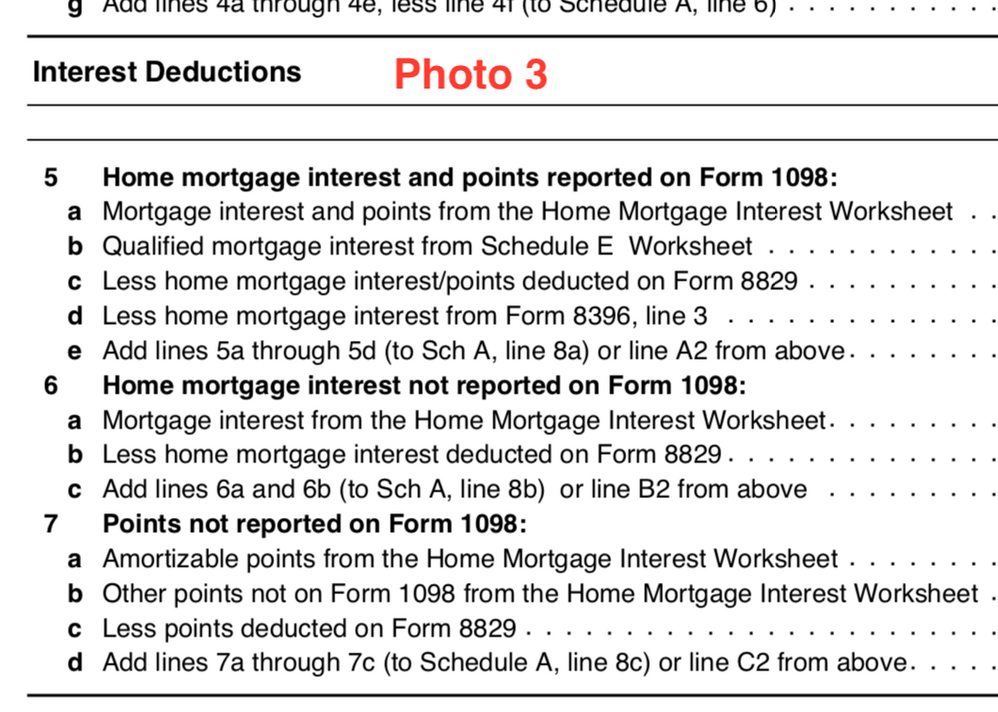

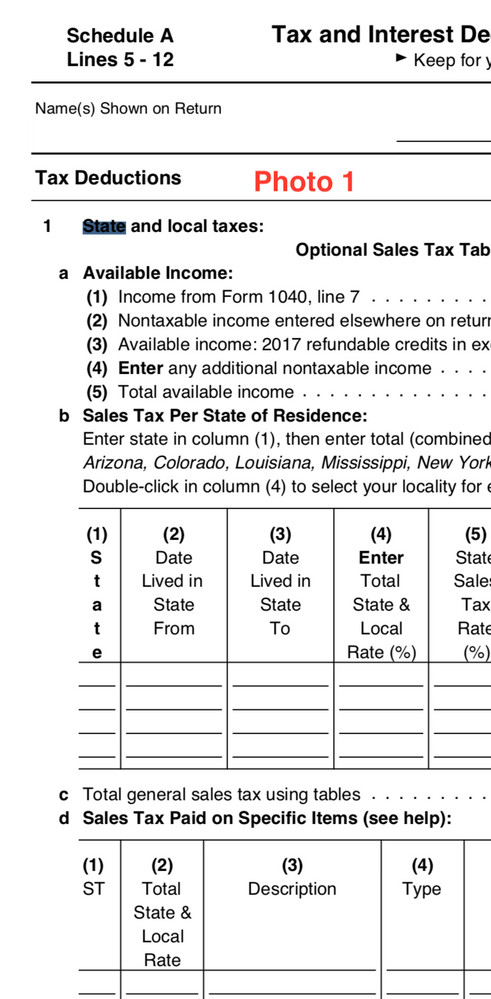

Yes, but you will be able to see the amount you claimed for state taxes paid on your 2018 federal schedule A.

Schedule A line 5a.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Total Refund Received in 2018 & Total of all your payments and withholding & 1099G

Im in NJ, What line do I use for my "Total of All your payments and withholding" In the Tell Us about your refund section? Is it "22" on "Schedule A Line 5" form from 2018?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Total Refund Received in 2018 & Total of all your payments and withholding & 1099G

It would be the number on the 2018 tax year Schedule A line 5a.

If the box next to line 5a is checked, the refund is not reported and not taxable.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Total Refund Received in 2018 & Total of all your payments and withholding & 1099G

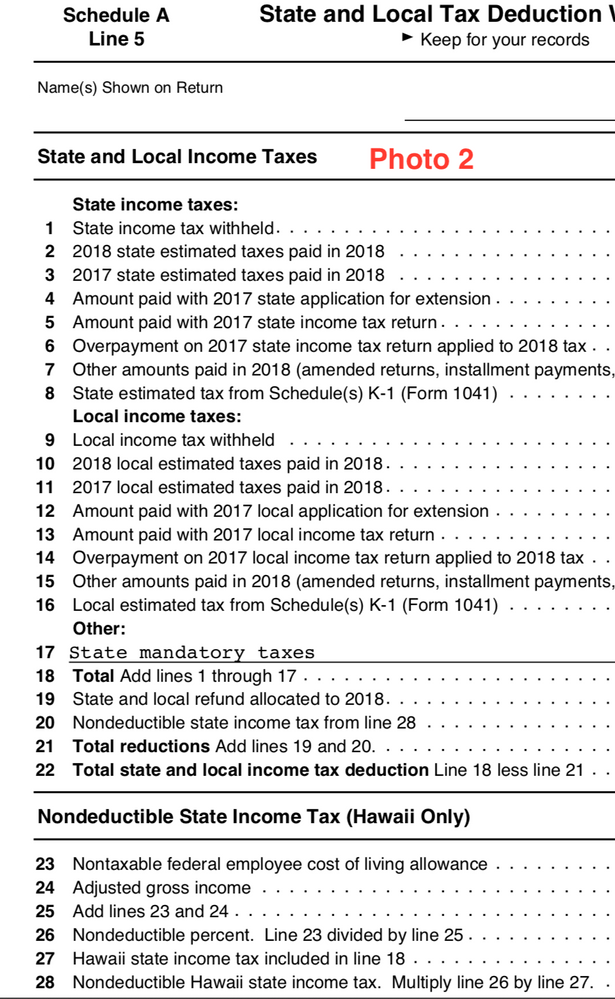

Please tell me which line number it is in which photo.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Total Refund Received in 2018 & Total of all your payments and withholding & 1099G

You need to look at the Schedule A from your 2018 Tax year.

If you took the Standard Deduction on your 2018 tax year return, the refund is not reported.

If you did itemize on your 2018 tax year return, but the box on line 5a is checked, the state refund is not reported.

If you did itemize and you used state income tax and not state sales tax, use the number on line 5a.

You can look at your 2018 tax return in "Your tax returns and documents" located on the Home Page of your account if you used TurboTax last year.

If you don't see Schedule A, look at your 2018 1040 line 8, if you claimed the Standard Deduction, your state refund is not reported on your 2019 return.

Photo 2 line 22 could be the amount you want, but that would only be if you did in fact itemize on your 2018 return.

Here is the line you would need to look at on your 2018 Schedule A IF you filed one.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Total Refund Received in 2018 & Total of all your payments and withholding & 1099G

So we took the standard deduction, we did not itemize.

So, what am I looking for?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Total Refund Received in 2018 & Total of all your payments and withholding & 1099G

Nothing. The state refund is then not reported, it is not taxable.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Total Refund Received in 2018 & Total of all your payments and withholding & 1099G

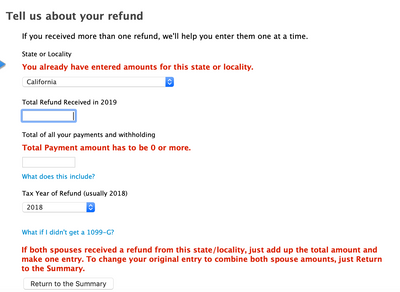

Hello RobertG,

But in my case I added my wife and now we are filling jointly. The program already had my info, but in the case of my wife, how would I find out what the total of all her payments and withholding are? Last year she did not itemize, so her taxes were simple i believe. Can we find out this info from her W2 or would I have to look at a copy of what she filed and where would i find it? Thank you so much?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Total Refund Received in 2018 & Total of all your payments and withholding & 1099G

If she did not itemize then her refund is not taxable on this year's return. You can skip entering any information regarding a refund received from a tax return that did not itemize deductions.

If all three of the following are true, your refund counts as taxable income:

- You itemized deductions last year, instead of taking the standard deduction

- You claimed state and local income taxes (not general sales taxes)

- Claiming the deduction helped you increase your federal refund or lower your tax bill

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Tax Year Prior to 2020: Total Refund Received in 2018 & Total of all your payments and withholding & 1099G

Hi KrisD15,

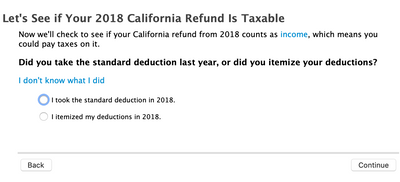

In my case, i took the standard deduction last year, but my wife before we got married last year she itemized. How would we go about completing this section since one of us itemized and one of us took the standard deduction? See screenshots. It looks like we would have to add the amounts we both received to make one entry. However, if we add both, after completing it says let's see if your 2018 refund is taxable? See screenshot, how do you answer this?

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

vjakovljevic

New Member

rmgressick

New Member

mckegan257

New Member

stalder5

New Member

chelsea23320

New Member