- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- mortgage and property tax deductions when renting primary residence

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

mortgage and property tax deductions when renting primary residence

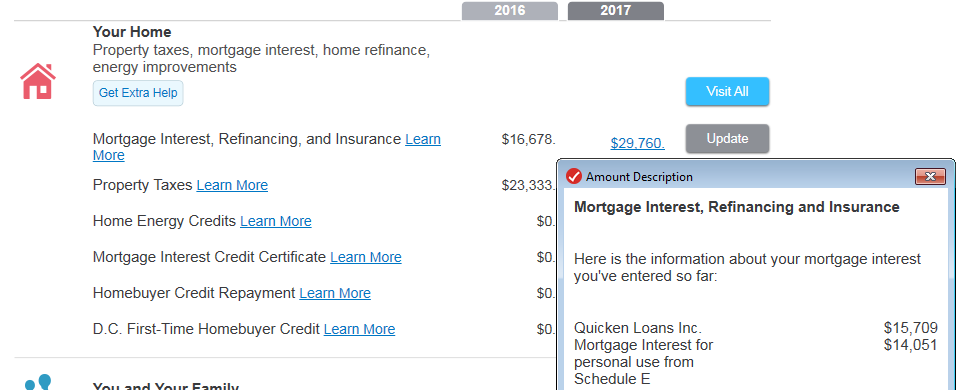

I rent our primary residence on AirBnB for some of the year when we travel. I entered our mortgage's 1098 info and our property taxes as federal tax deductions. However completing Schedule E for the rental income & expenses also asks for (some of) this information, and calculates the rental deduction (and other expenses) based on the number of days of the year it was rented out vs used by us. In doing so it seems to duplicate these deductions and my refund is much larger. This does not seem correct, however. You can see in the screenshot of the detail that pops up when clicking on the mortgage interest total (and the property tax detail does the same thing).

Should I not report these amounts as personal home loan & tax deductions in this case? That seems to mean that I don't enter my 1098 details, since all the rental section asks for is the total amount, not the details that the 1098 form asks for. Is that the right thing to do? (It seems odd not to report the 1098, especially since the IRS surely knows I received one.) Are there other things that I should be aware of duplicating in this case?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

mortgage and property tax deductions when renting primary residence

TurboTax will allocate rental interest/property taxes when you rent a part of your home. Allocate manually the rental use portion and your personal portion. The total of the two sections should not exceed your 1098 total.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

mortgage and property tax deductions when renting primary residence

I experienced the same with my first year partial rental of my personal residence. My Mortgage Interest and RE Taxes paid was split between my rental (Sch E) and the balance went to my Sch A. However, I have a Sch. C business in my home as well, so both Interest and Taxes were overstated on my Sch A. The Tax and Interest Worksheet has a built in adjustment to limit the amount of Mortgage Interest paid going to Sch A. There is no such convenient place to adjust RE Taxes paid.

I solved this by determining what should appear on Sch A Row 10 for Mortgage Interest as:

Mortgage Interest paid times (100% - Sch E wks alloc. rate on Row Q, less Form 8829 alloc. rate on row 7)

Exa: $10,000 mort. int. * (100% - 20% (rental allocation) - 30% (use of home allocation)

or $10k * 50% = $5,000

This adjusted Sch A Mortgage Interest should be entered on Tax and Int Wks - Mortgage Interest Limited Smart Worksheet on Row A2 as the limit of Mort. Int. to appear on Sch A.

Using the same process for RE Taxes paid to obtain the amount that should appear on Sch A Row 6, I adjusted the same Tax and Interest Wks by overriding the entry on Row 2d or 2e such that the number appearing on Row 2g is the amount I calculated should appear on Sch A such that all RE Taxes reported equal what I paid.

Unfortunately, I figured this out after I electronically filed so I need to amend my return. While this case impacts a limited number of tax filers, I consider it a bug that needs correction by TurboTax. Of course the obvious response is to buy the more expensive software that likely, but not necessarily, resolves this error.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

mortgage and property tax deductions when renting primary residence

Hello

Interested on your question because I am on the same situation. DId you do this for mortgage interest and property taxes?

Any suggestions how to handle this on the 2018 version?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

mortgage and property tax deductions when renting primary residence

Did you figure it out? I am in same situation as well. I have Primary residence where i rent out 55% of it. When I enter mortgage interest and Property taxes in Rental section AND deductions section, they are way more once i get to the deduction portion of the turbotax online site. I couldn't figure out the math. I quadrupled checked to make sure I checked the "Let Us Calculate Your Expense Deductions for You" box and indicated the percentage. I am thinking of doing all the calculations myself if this isn't resolved. I feel this is a bug in turbotax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

mortgage and property tax deductions when renting primary residence

Did you figure it out? same problem here. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

mortgage and property tax deductions when renting primary residence

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

mortgage and property tax deductions when renting primary residence

One would think that designing a software package that splits RE Interest and taxes to a number of schedules would include a reconciliation. One would be wrong... The only way to fix it was to overwrite my Mortgage Interest and RE Taxes on my Schedule A to correctly state the totals paid.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

mortgage and property tax deductions when renting primary residence

Yes, I had to override both Mortgage Interest and RE Taxes on Sch. A to reconcile what I paid.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

npubbi

New Member

lnk-fr

Level 2

ScubaGT63

Level 3

cashrn-gmail-com

New Member

JeanAtkinson

Level 3