- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- I keep getting an error about my 1099 misc income from Robinhood LLC that I cannot fix, and thus cannot file my taxes.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

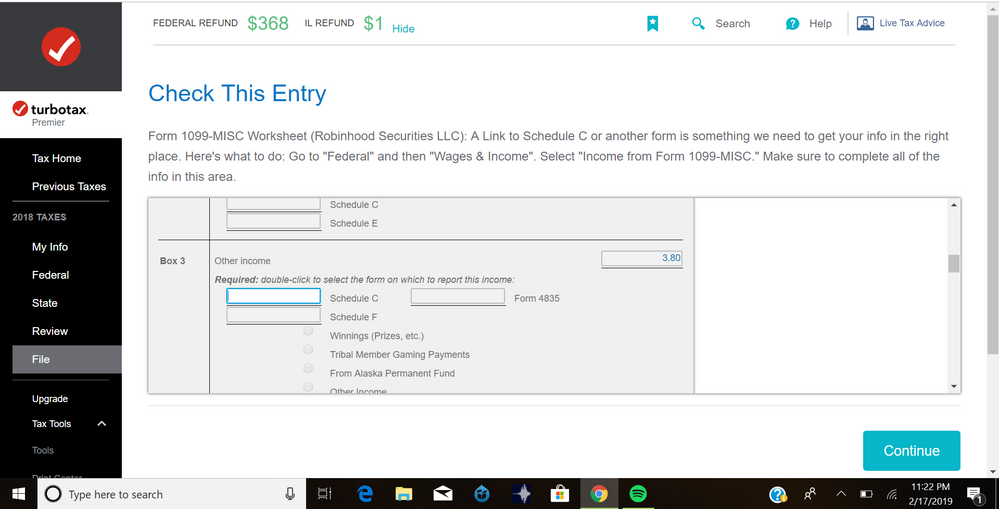

I keep getting an error about my 1099 misc income from Robinhood LLC that I cannot fix, and thus cannot file my taxes.

I received a stock worth $4 from Robinhood for a friend joining, and upon importing tax information from Robinhood, have to file taxes on it. I filled out all boxes, but got an error when I tried to efile. So I have gone back, reviewed, edited, and reentered all information boxes they provide, but still get the same error message preventing me from filing.

I do not want to pay $45 for the live assistance for an additional $4 in tax filings because Turbo Tax is insisting my schedule C is incorrect when it is not. I am already paying for premium to file taxes for Robinhood when I have not taken any income from them (all funds accrued are still invested in the platform and have yet to be pulled in any amount) This is a bitter cherry on top, so please help.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I keep getting an error about my 1099 misc income from Robinhood LLC that I cannot fix, and thus cannot file my taxes.

"I received a stock worth $4 from Robinhood"

Stock would not be repoted on a 1099-MISC on SCH C, as SCH C is for "EARNED" business income. You did not provide a product or service to get that stock. So there's no way it's earned income. In fact, it would not be reported on 1099-MISC at all. So if a 1099-MISC is what you have, what box on that 1099-MISC is the income reported in?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I keep getting an error about my 1099 misc income from Robinhood LLC that I cannot fix, and thus cannot file my taxes.

You must make the indications to TurboTax that this is Other Income. Edit the Form 1099-MISC, indicate that non of the uncommon situations apply, indicate that it did not involve work like your main job, indicate that you got it only in 2018 and indicate that it did not involve the intent to earn money.

If this doesn't work, delete the Form 1099-MISC and reenter it manually.

(Presumably his was resolved long ago since the question was posted 4 months ago.)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I keep getting an error about my 1099 misc income from Robinhood LLC that I cannot fix, and thus cannot file my taxes.

I just want to say that it is February 2024 and I am getting the EXACT error in my Robinhood Crypto 1099-MISC form. So the problem has not been solved. Thanks to your instructions I can continue filing. Kudos!

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Lala533

New Member

Head-Mastodon

Returning Member

therosyn123

New Member

serendipity

Returning Member

goldboy441

Returning Member