- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: How to report excess deferral (401k over contribution) in 2018 without a 1099R?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report excess deferral (401k over contribution) in 2018 without a 1099R?

I have excess deferral in 2018, as I had switched jobs. I spoke to plan managers in my previous as well as current employer and they are unable to return the excess amount.

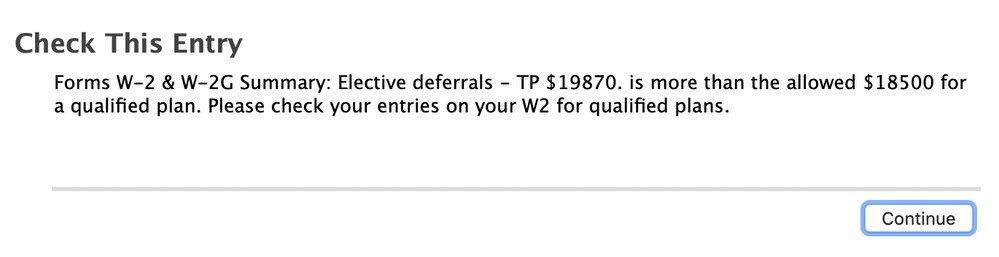

I have followed the steps mentioned in the link ('https://ttlc.intuit.com/questions/4416797-how-to-report-excess-2017-401-k-contributions-on-the-2017...), but I still get error while e-filing taxes (attached):

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report excess deferral (401k over contribution) in 2018 without a 1099R?

There are two issues here.

1) The excess is still taxable income to you even if it cannot be returned. That means that a 2018 excess must be reported as 2018 wages on line 1 on the 1040 form. Since it cannot be returned in this situation it can remain in the account but you will be taxed again on the same money when eventually withdrawn. This is explained in IRS Pub 525 page 10.

https://www.irs.gov/pub/irs-pdf/p525.pdf

Excess 401(k) deferrals should be reported in:

(There are several screens to click through to get to the right place)

Miscellionious Income ->

Other Income not reported on a W-2 ->

Other wages (yes) ->

House Hold employee (Continue) ->

Sick Pay (Continue) ->

Other earned income (yes) (Includes excess salary deferrals)->

Source of income (other) ->

Any other income - enter the amount of the excess deferral and an explanation.

This will add the returned excess to your 2018 wages on line 1 .

2) There is currently an TurboTax bug that is prevent e-file when the W-2 has excess contribution.

The bug is scheduled to be fixed on the 4/5/19 update, so try again on 5/6/19 after the update.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report excess deferral (401k over contribution) in 2018 without a 1099R?

Just checking when is the fix for this issue expected to be available. I restarted TurboTax Premiere to see if there were updates available and it said the software is unto date.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report excess deferral (401k over contribution) in 2018 without a 1099R?

An update currently planned for April 12th, 2019 will resolve the issue of a looping interview preventing e-file. You may still see a warning of excess contribution, but e-file will be available.

[edited 4/10/19 | 6:47Pm EST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report excess deferral (401k over contribution) in 2018 without a 1099R?

@HollyP- Your click "here" link does not work.

Yes, TurboTax does not appear to be correcting this defect and the only remedy to to mail file.

This is probable the link that Holly was posting.

https://ttlc.intuit.com/questions/4698409-excess-401-k-contribution-preventing-e-file

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report excess deferral (401k over contribution) in 2018 without a 1099R?

Thanks for the heads up @macuser_22, you were right that was the link and I updated my response.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report excess deferral (401k over contribution) in 2018 without a 1099R?

Great news! An update currently planned for April 12th, 2019 will resolve the issue of a looping interview preve...

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report excess deferral (401k over contribution) in 2018 without a 1099R?

The instructions on Deluxe Turbo tax say to report excess contributions on a 401 K that was withdrawn by April 15 by creating. 1099-R and adding as much information, then selecting P which is for 2017. Other instructions say to select 8, excess contributions for

2018 and to tell TT that you are doing a 20191099-R but I don't see where do you tell TT.

Searching in TT community most responses in TT community and the internet we are told put in :

TT Instructions in community but not in the program, which tells you to create 1099. Which is correct?????

Do I report this excess under Misc Income with the steps below?

Go to Wages & Income -> Less Common Income -> Miscellaneous Income, 1099-A, 1099-C.

Click Other income not already reported on a Form W-2 or Form 1099.

Answer Yes, you received other wages.

Proceed to the Any Other Earned Income page and answer Yes.

click past next 2 screens till you reach the excess salary deferral screen

Did you earn any other wages answer YES

Choose "OTHER"

"Excess 401k salary deferral" in the description and enter the amount including earnings that were withdrawn

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report excess deferral (401k over contribution) in 2018 without a 1099R?

@Belendez1Both methods are equally correct. Both the Code P and "Misc Income" will put the excess on the 1040 line 1.

The Code P "2017" becomes "2018" an a screen after you enter the 1099-R where is asks if it is 2018 or 2019 1099-R.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report excess deferral (401k over contribution) in 2018 without a 1099R?

Thank you so much, I just wish there was one way as its confusing when you research it.

Going with the Misc, the money was reimbursed this week and we will get the 1099-R next year.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report excess deferral (401k over contribution) in 2018 without a 1099R?

@macuser_22 So I did the method where I added it in as Other Income etc. But when TT did the final review of my return it's popping up saying I need to fill out a 1099 (payer info, recipient info, drop-down box with code, etc.).

I got from your reply earlier today that the 1099 wouldn't need to be filled out if we did the "Other Income" etc.

What am I not understanding? How do I resolve this?

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report excess deferral (401k over contribution) in 2018 without a 1099R?

ALSO, it keeps asking for the tax ID of the 401k company (who is presumably the payer).

I don't have it.

So basically I thought I was resolving this through the "Other Income" reporting, and now it's asking me to do the 1099 thing. Which I understood from your post to be two different ways to skin the cat. Why are they asking me to skin the cat both ways, and if I were to do so, would that be a mess?

Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report excess deferral (401k over contribution) in 2018 without a 1099R?

never mind, it seems to have resolved by me going into forms view and deleting something. What a nightmare.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to report excess deferral (401k over contribution) in 2018 without a 1099R?

I did not post the "Miscellionious Income" method (someone else did and might be missing some steps)

Here is my method with the screens and answers:

(There are several screens to click through to get to the right place)

Miscellionious Income ->

Other Income not reported on a W-2 ->

Other wages (yes) ->

House Hold employee (Continue) ->

Sick Pay (Continue) ->

Other earned income (yes) (Includes excess salary deferrals)->

Source of income (other) ->

Any other income - enter the amount of the excess deferral and an explanation.

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

htb14

Returning Member

mcht

New Member

mcht

New Member

dlj56

New Member

20tflbtt20

New Member