- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Adoption Credit 2017 and 2018, for 2018 tax return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adoption Credit 2017 and 2018, for 2018 tax return?

We started the adoption paperwork / applications / home study back in 2017 and the cost was about $4,000 (entire year in 2017); but we did not file it with the tax in April 2018.

Then we got the baby in Nov 2018 and everything finalized (still waiting for the birth cert, etc); the total cost in 2018 (including travel expenses, court fee, attorney fee, etc) that listed in the eligible items were total about $14,000. This is a domestic adoption.

Is this going to be correct if we put the max amount for the 2018 tax which is $13,840. and carry forward the remaining ($4,000) to next tax year 2019? Our current income taxable amount is about $16,000 (we still have some medical bills and other charity items to be added).

While using the turbo tax, we finally able to get the adoption credit form works (clicking different boxes); but it seemed that the form did not limit our amount to $13,xxx since when we put down 18,xxx, it was allowed to do so.

And thanks everyone in advance if you have suggestion or recommendations.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adoption Credit 2017 and 2018, for 2018 tax return?

What you describe is not correct.You should be able to claim the $13840 tax credit in 2018, and carry forward any part of that amount that is unused in 2018 to next year's tax. You are not allowed to carry forward amounts in excess of $13840, the total credit allowed.

When you say that your "current income taxable amount is about $16,000" do you mean that's your taxable income (before you enter your medical and charity expenses) or is that your total income tax?

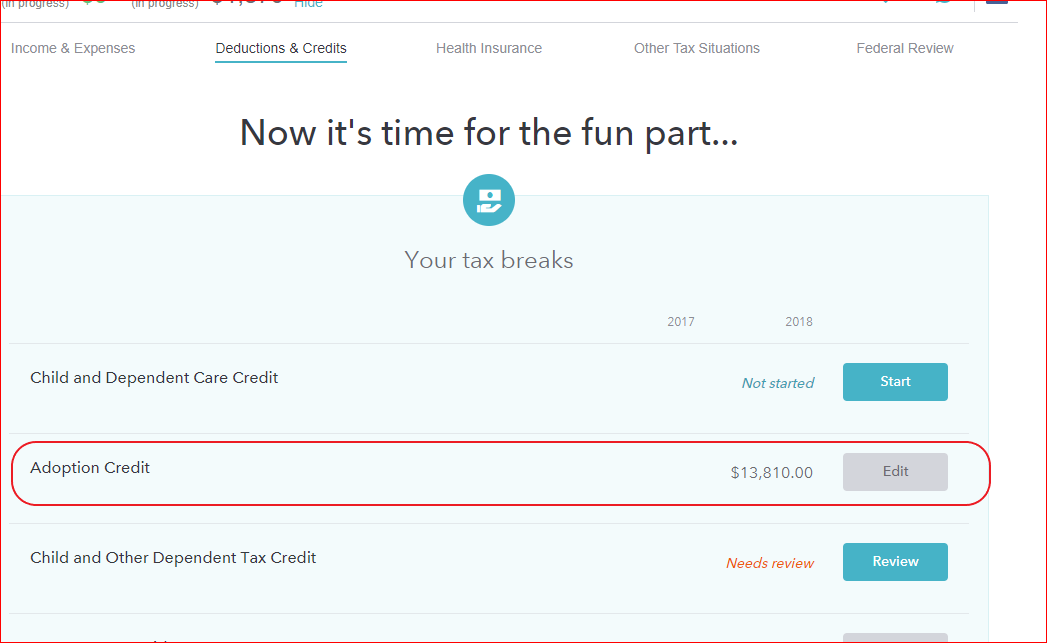

When I enter adoption expenses of $4000 for 2017, and $14,000 for 2018 (the year of adoption) I get an allowable credit of $13,840, which shows under Your Tax Breaks under Deductions & Credits. Where are you seeing that you are allowed the full $18,000 as an adoption credit?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adoption Credit 2017 and 2018, for 2018 tax return?

IsabelleG,

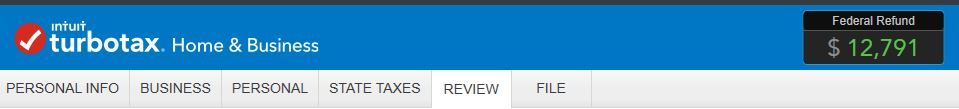

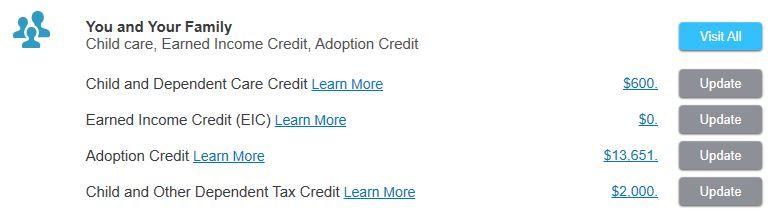

I input all items, including medical expenses, charity, etc. Then turbotax calculated we owed IRS $3,xxx (in red color). After clicking and entering the deduction of the Adoption of $13,xxx, we now have a return of nearly $10,000 (in green color); plus there were items that the turbotax found out as error and we re-entered those. We thought the adoption is only a credit; rather than a refundable amount. (The previous noted $18,xxx was mistakenly as the total in the "You and Your Family").

In other word, we thought to enter only $3,xxx for the adoption credit to even out what we owed IRS and carryover the rest $10k to next year. I am not sure if we do it correct; we thought we did something wrong but not sure.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adoption Credit 2017 and 2018, for 2018 tax return?

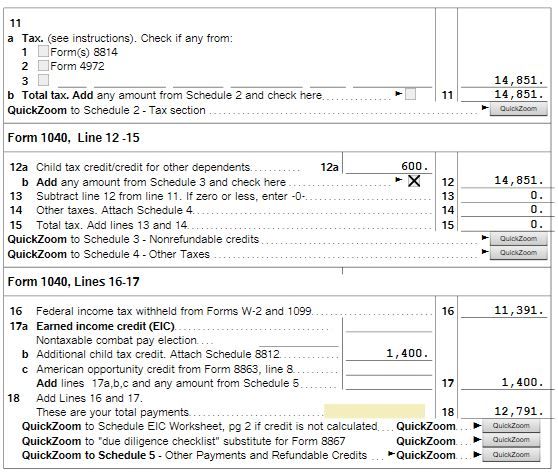

You are correct that the credit is not refundable; it just reduces your tax, and you carry the rest over. It looks like you are using the Desktop version of TurboTax, so you can look at the forms you have created.

Go to the upper right corner of your screen and click on FORMS. Then on the left side of your screen, click on 1040.

What numbers are in boxes 11-18? That would give us a clue as to what's happening.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adoption Credit 2017 and 2018, for 2018 tax return?

Thank you for sending your question.

To ensure a quicker response, please be sure to post your question publicly in our Community.

You’ll get answers more quickly, and other community members will be able to learn from the discussion.

· You can choose a topic here: https://ttlc.intuit.com/community/Discussions/ct-p/personal-finance

· Then click the “Ask a Question” button

If you are interested in receiving one-on-one assistance privately, I’d recommend TurboTax Live. You can learn more about it here: https://turbotax.intuit.com/personal-taxes/online/live/.

Ps, I'm sorry we are unable to call you...

Thank you! Have a great day!

ttlc.intuit.com

Personal Finance

Ask and discuss questions related to using Intuit Turbo or explore and participate in discussions about personal finance, your credit score and more.

turbotax.intuit.com

TurboTax® Live ‐ Talk to Certified Tax Expert On‐Demand

TurboTax Live connects you with a tax expert directly from your computer for tax advice from our certified CPAs and EAs. Have a tax preparer review your tax return with you and get unlimited advice for your unique situation.

Again, if you indicate what numbers are in boxes 11-18 on your 1040, it would direct us as to what's going on with your return. Your refund or balance due is a calculation which involves tax due, credits and withholding. Those lines of your return could clear that up.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adoption Credit 2017 and 2018, for 2018 tax return?

You enter the full amount of your expenses ad the program will carry forward any unused amount. Don't lower your expenses to compensate for other deductions you may have. Such deductions, and credits, are taken in a specific order.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adoption Credit 2017 and 2018, for 2018 tax return?

This is the snap shot...I think I entered everything correctly.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adoption Credit 2017 and 2018, for 2018 tax return?

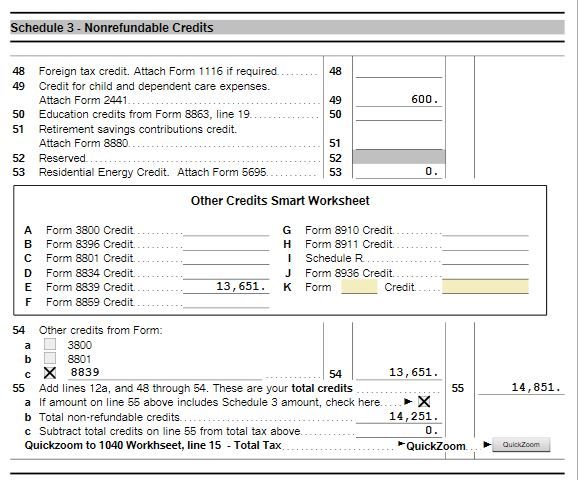

@firstadoptionparent18: Thanks for sharing that screenshot. If you click on QuickZoom to Schedule 3, Nonrefundable Credits, we will see what that amount on line 12 is comprised of. What I see is the tax of $14851 being reduced to zero because of your nonrefundable credits. This would include your Adoption Credit.

Next, you are given credit for your Federal Tax withholding, and the refundable Additional Child Credit, which results in your $12,791 refund. Other than not knowing what exactly comprises your Nonrefundable Credits, this makes perfect sense to me. Your adoption credit isn't being refunded, but your tax was reduced to zero and you're getting your withholding back.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adoption Credit 2017 and 2018, for 2018 tax return?

Here is the snap of Schedule 3.

Questions: In other word, our withheld (both my spouse and myself) from W-2 and 1099 is about $11,391 on line 16 on 1040, these will be refunded to us due to the adoption credit was around $12,791?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adoption Credit 2017 and 2018, for 2018 tax return?

Yes, that's it! Your Adoption Credit, and Child and Dependent Care Credit total $14251. Your total income tax is $14851. That leaves $600 in tax left, which is reduced to zero by $600 of your Child Tax Credit. Your refund consists of your withholding of $11391 and your Additional Child Tax Credit (the refundable part) of $1400.

Based on the information that you provided here, it looks like everything has been computed correctly.

Thanks for getting back to us!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adoption Credit 2017 and 2018, for 2018 tax return?

Thanks for the message.

However, the adoption agency and the attorney just updated everything and it was told that in their fees, there were some other items that we can claim and now we have to redo everything.

The total (with both agency, attorney and home study fees), the total now is updated to be $12,000.00 on top of what we initially put in the turbo tax (so the total now is nearly $26,000). Since the maximum in 2018 credit is only $13,810, will we allow to carry over the extras ($26,000 - $13,810 = $12,910) to the 2019 tax season?

(*Note that the updated calculation was based on our request and the agency's record. They told us since the home study in Maryland was out of our own pocket and the part of the Attorney fee was not listed in their document (also our own pocket), but they helped us to break it down and update everything. We received the update just last night as 1/30/2019).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adoption Credit 2017 and 2018, for 2018 tax return?

No, the Maximum Credit is $13810. You don't get a carryover for additional expenses, you would only get a carryover if part of that $13810 was not used to reduce your 2018 tax. Anything that you paid above that amount doesn't qualify for the credit, and can't be carried forward.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adoption Credit 2017 and 2018, for 2018 tax return?

No, the Maximum Credit is $13810. You don't get a carryover for additional expenses, you would only get a carryover if part of that $13810 was not used to reduce your 2018 tax. Anything that you paid above that amount doesn't qualify for the credit, and can't be carried forward.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Adoption Credit 2017 and 2018, for 2018 tax return?

No, the maximum credit is $13,810. If you didn't get to use the entire credit in 2018, because your income tax wasn't high enough, you could carry over whatever wasn't used to reduce your 2018 tax. But any expenses over the $13810 are not able to be carried over.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

jkeaveny07-gmail

New Member

cyp54ress

New Member

jaxgab

Returning Member

jaxgab

Returning Member

8c2e45e080a1

New Member