- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Get your taxes done

- :

- Re: 1098-T and scholarships

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098-T and scholarships

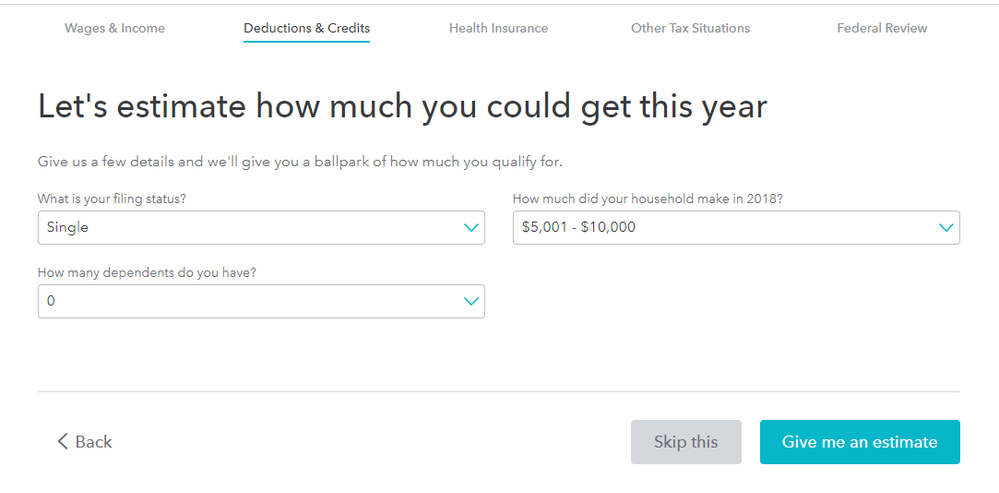

Filed my taxes and entered my son's 1098-T. It said because of his scholarship it was seen as income so he would need to file it on his own tax return. So we started another return. He has no other income other than the scholarship but when I go to input his 1098-T it only gives me an estimated household income drop down and marital status box. Have no idea what to do here.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098-T and scholarships

Your son may not have to file his own return since you say that scholarship is his only income.

If the excess scholarship is his only income and it is less than $12,000 for the year, your son is not required to file at all.

If a student's earned income (such as W-2), when added to scholarship exceeds $12,000, then he is required to file his own tax return. If he is required to file, be sure that he indicates on his tax return he is being claimed by someone else.

As to the screenshot, you seem to be in our taxcaster website.. an area where we estimate the income...not in the TurboTax online for preparing the return. Please use this link to start a return, if your son must file. Your son won't get anything back since all he is doing is reporting excess scholarship as income (again, if he is required to file at all).

I'm also enclosing filing requirements for dependents if you'd like to read more.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098-T and scholarships

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098-T and scholarships

Your son may not have to file his own return since you say that scholarship is his only income.

If the excess scholarship is his only income and it is less than $12,000 for the year, your son is not required to file at all.

If a student's earned income (such as W-2), when added to scholarship exceeds $12,000, then he is required to file his own tax return. If he is required to file, be sure that he indicates on his tax return he is being claimed by someone else.

As to the screenshot, you seem to be in our taxcaster website.. an area where we estimate the income...not in the TurboTax online for preparing the return. Please use this link to start a return, if your son must file. Your son won't get anything back since all he is doing is reporting excess scholarship as income (again, if he is required to file at all).

I'm also enclosing filing requirements for dependents if you'd like to read more.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098-T and scholarships

His total scholarship for 2018 was only $7000 all of which was used towards tuition. And he has no other income so you're saying I don't need to file for him, correct? Thank you for your response, but I assure you this screen shot is directly from turbo tax online while I was filling out his return. If you go to deductions and education one of the options is 1089-T when I click to review it takes me to the screen I captured. Thanks again for your help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098-T and scholarships

Thank you for assuring me about the screenshot, I did not receive the same result when I tried to duplicate it... but no matter. Since the entire scholarship was used towards tuition, your son does not need to file 1098-T nor his return. There is nothing taxable there. Good luck in 2019!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098-T and scholarships

Many thanks!! Good luck to you as well!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1098-T and scholarships

Thank you very much 🙂

Still have questions?

Make a postGet more help

Ask questions and learn more about your taxes and finances.

Related Content

Luke338482

New Member

ndfontenot

New Member

confused yet in college

New Member

amberjack9

New Member

sara98

New Member